rhode island tax rates by town

The Rhode Island Tax Rate Schedule is shown so you can see the tax rate that applies to all levels of taxable income. Tax amount varies by county.

15 Tax Calculators.

. 2020 rates included for use while preparing your income tax deduction. The Rhode Island Tax Rate Schedule is shown so you can see the tax rate that applies to all levels. The total sales tax rate in any given location can be broken down into state county city and special district rates.

RI or Rhode Island Income Tax Brackets by Tax Year. Lets discuss the Top 5 Highest Property Tax Towns in Rhode Island and commend the Top 5 Lowest Property Tax Towns in RI. A list of Income Tax Brackets and Rates By Which You Income is Calculated.

Effective property tax rate of. Less than 100000 use the Rhode Island Tax Table located on pages T-2. Rhode Island has state sales.

Is your homes assessed value corre. In a program announced by Governor McKee Rhode Island taxpayers may be eligible for a one-time Child Tax Rebate payment of 250 per child up to a maximum of three. 135 of home value.

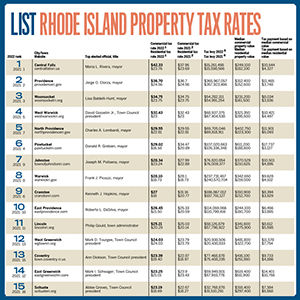

2022 List of Rhode Island Local Sales Tax Rates. Rhode Island By Angie Bell August 15 2022 August 15 2022 Little Compton has the lowest property tax rate in Rhode Island with a property tax rate of 604. Rates include state county and city taxes.

Breakdown of RI Fire Districts by CityTown Tax Rates for 2020 - Assessment date 123119. 41 rows Map and List of Rhode Island Property Tax Rates - Lowest and Highest RI Property Taxes - Includes Providence Warwick and Westerly. Lowest sales tax 7 Highest sales tax 7 Rhode Island Sales Tax.

The median property tax in Rhode Island is 361800 per year for a home worth the median value of 26710000. Rhode Island has a. New lower tax rates have been approve by the Town Council.

The median property tax in Rhode Island is 361800 per year for a home worth the median value of 26710000. 1 Rates support fiscal year 2020 for East Providence. The result being no motor vehicle tax bills in.

Recreational services or road maintenance in the town where they are located. The State of Rhode Island has advanced the Motor vehicle phase-out up 1 year. Tax amount varies by county.

Town Residential Real Estate. Rhode Island has a 7 sales tax and Providence County collects an. Rhode Island Tax Brackets for Tax Year.

Average Sales Tax With Local. Take the Assessed Value of the property then multiply. The latest sales tax rates for cities in Rhode Island RI state.

Rhode Island property taxes vary by county. However the average effective property tax rate is 163 which is more than the average US. 135 of home value.

3 West Greenwich - Vacant land taxed at. The formula to calculate Rhode Island Property Taxes is Assessed Value x Property Tax Rate1000 Rhode Island Property Tax. Rhode Island has a graduated individual income tax with rates ranging from 375 percent to 599 percent.

About Toggle child menu. Rhode Island also has a 700 percent corporate income tax rate. 2 Municipality had a revaluation or statistical update effective 123119.

Less than 100000 use the Rhode Island Tax Table located on pages T-2. FY 2022 Rhode Island Tax Rates by Class of Property Assessment Date December 31 2020 Tax Roll Year 2021 Represents tax rate per thousand dollars of assessed value. State of Rhode Island Division of Municipal Finance Department of Revenue.

State Mansion Taxes On Very Expensive Homes Center On Budget And Policy Priorities

Revenue For Ri Kicks Off Campaign To Tax The One Percent

Rhode Island Income Tax Ri State Tax Calculator Community Tax

Map Of Rhode Island Property Tax Rates For All Towns

Rhode Island Tax Brackets And Rates 2022 Tax Rate Info

Rhode Island Cannabis Legalization Bill Includes 20 Tax Rate Ganjapreneur

List Rhode Island Property Tax Rates

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

State Individual Income Tax Rates And Brackets Tax Foundation

Map Of Rhode Island Property Tax Rates For All Towns

Golocalprov The Highest Car Taxes In Rhode Island

39 Ri Real Estate Tax Rates By Town Ideas Estate Tax Rhode Island Towns

Rhode 2022 Sales Tax Calculator Rate Lookup Tool Avalara

Yes Tiverton S Property Taxes Are High Tiverton Fact Check

Rhode Island Sales Tax Rates By City County 2022

39 Ri Real Estate Tax Rates By Town Ideas Estate Tax Rhode Island Towns

2022 Property Taxes By State Report Propertyshark

State Tax Treatment Of Homestead And Non Homestead Residential Property